Japan's economy falls into recession as virus takes its toll

GETTY IMAGES

GETTY IMAGESJapan has fallen into recession for the first time since 2015 as the financial toll of the coronavirus continues to escalate.

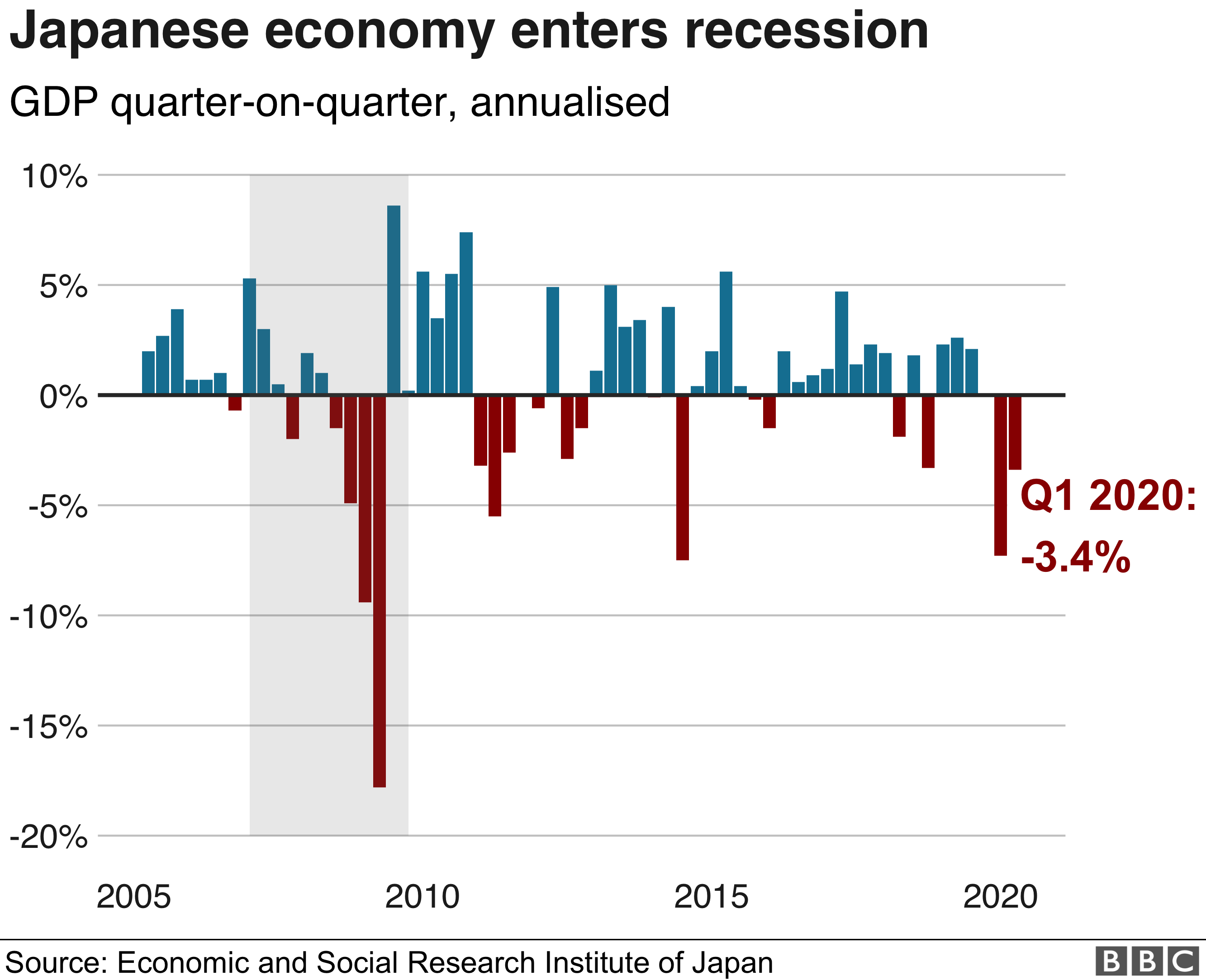

The world's third biggest economy shrank at an annual pace of 3.4% in the first three months of 2020.

The coronavirus is wreaking havoc on the global economy with an estimated cost of up to $8.8tn (£7.1tn).

Last week, Germany slipped into recession as more major economies face the impact of sustained lockdowns.

Japan did not go into full national lockdown, but issued a state of emergency in April which severely affected supply chains and businesses in the trade-reliant nation.

- Coronavirus pushes German economy into recession

- What shape will the coronavirus recession be?

- Coronavirus 'could cost global economy $8.8tn'

The 3.4% fall in growth domestic product (GDP) for the first three months of 2020, follows a 6.4% decline during the last quarter of 2019, pushing Japan into a technical recession.

Consumers in Japan have been hit by the dual impact of the coronavirus and a sales tax hike to 10% from 8% in October.

While Japan has lifted the state of emergency in 39 out of its 47 prefectures, the economic outlook for this current quarter is equally gloomy.

Analysts polled by Reuters expect the country's economy to shrink 22% during the April-to-June period, which would be its biggest decline on record.

The Japanese government has already announced a record $1 trillion stimulus package, and the Bank of Japan expanded its stimulus measures for the second straight month in April.

Prime Minister Shinzo Abe has pledged a second budget later this month to fund fresh spending measures to cushion the economic blow of the pandemic.

How can Japan turn things around?

Japan faces a unique challenge as its economy has been stagnant for decades, compared to the more buoyant economies of rivals the US and China.

Japan also relies heavily on exporting its goods and has little control over consumer demand in other countries, which has been severely impacted by coronavirus lockdowns. Many of its biggest brands, such as car firms Toyota and Honda, have seen sales slump across the world.

Tourism, which has long been a boost to the Japanese economy, has also been hit hard as the pandemic keeps foreign visitors away. Japan has had more than 16,000 confirmed coronavirus cases and around 740 deaths.

How does it compare to other major economies?

Things look bleak for the Japanese economy in the short term, along with other major economies around the world. But despite being the first of the world's top three economies to officially fall into recession, the country actually appears to be doing better, or less badly, than other major economies.

While economists predict Japan's economy will shrink at an annual pace of 22% in the April-to-June period, they also predict that the US could contract by more than 25%. The 3.4% annual rate of decline in the first quarter also compares favourably to the 4.8% the US suffered in the first three months of this year.

This was the sharpest decline for the US economy, the world's biggest, since the Great Depression of the 1930s.

China, the world's second largest economy, saw economic growth shrink 6.8% in the first three months of 2020 compared with a year earlier, its first quarterly contraction since records began.

Both of those economies have not yet been confirmed as having fallen into a technical recession, which is defined as two consecutive quarters of negative growth, but most economists expect them to in the coming months

Comments

Post a Comment